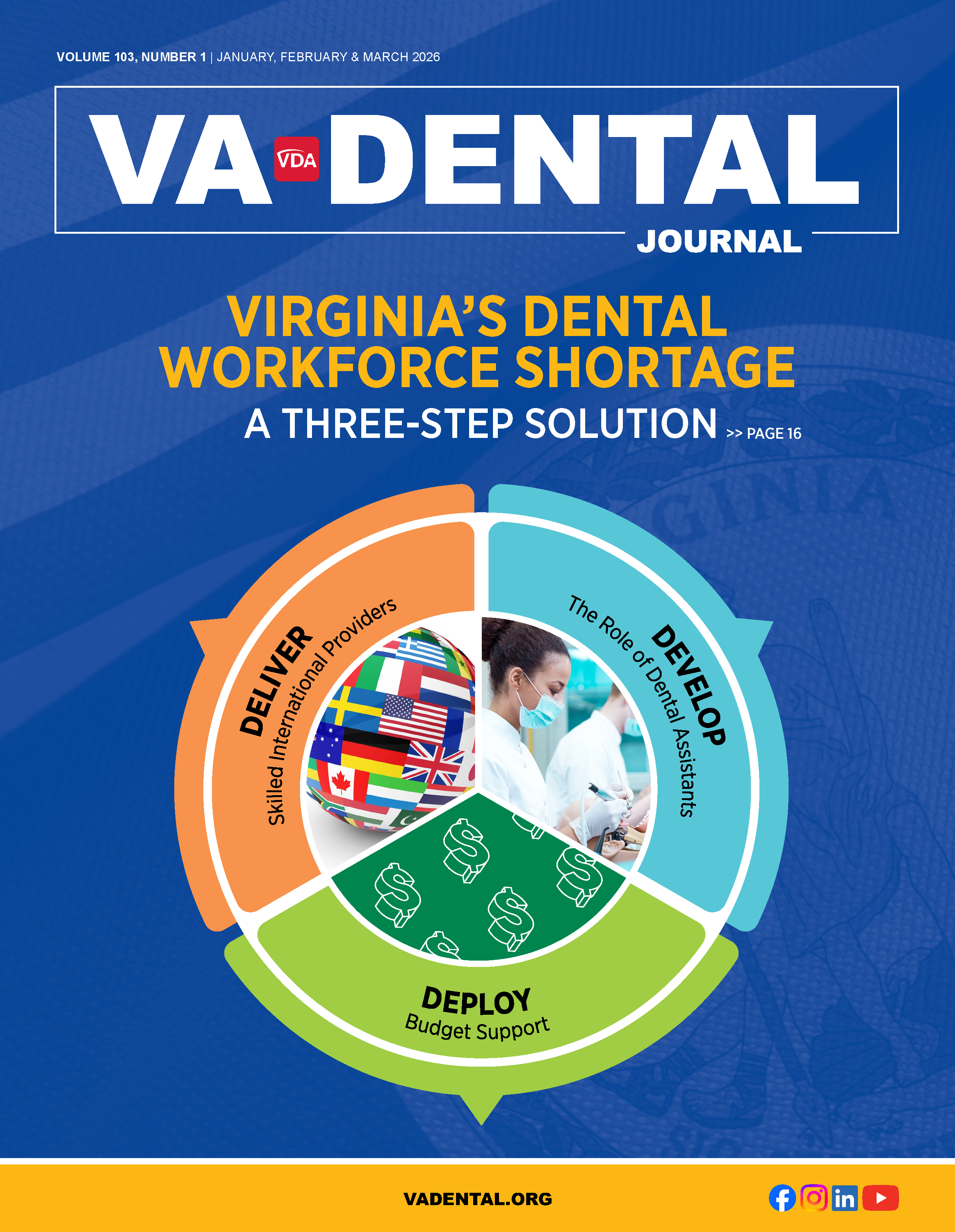

VDA Action Alert

Action Needed to Support VDA Workforce Legislation

Renew your membership

Keep your support and member resources through 2026.

Save the Date!

Make plans to attend.

Real Conversations. Real Progress.

The Fulcrum Podcast is a must-listen for all Virginia dental professionals.

ACTION CENTER

NEWS

Donate today! Tax credits will be distributed as donations are received and will most likely be gone before the program term ends in June 2020.

Your contribution to the VDA Foundation (VDAF) may now be eligible for Virginia's Neighborhood Assistance Program (NAP). NAP offers Virginia state income tax credits to individuals and eligible donors of qualified, participating organizations. The VDAF now participates in the NAP program.

Contributions of $500 or more by individuals or married couples to qualified Virginia charitable organizations like ours are eligible for a 65% tax credit. Please hurry! Tax credits will be distributed as donations are received and will most likely be gone before the program term ends in June 2020.

When a NAP tax credit eligible gift is received, the VDAF will send the required forms to you for completion. When the forms are returned we will submit them to the state office. Within a few weeks of the donation, you will receive a certificate for your tax credits.

Tax credits are available on a first-come, first-served basis, so don't delay! Donate today. Contact Tara Quinn for more information.